Are you focusing on only half of the investment picture?

Many of our clients work with more than one money manager. Each manager may bring a specialty and focus to a particular area of their portfolio. Our focus is two fold. First we concentrate on protecting gains during corrections. But we also focus on capturing the bulk or more of the upward moves, in between those bear markets. It is important to focus on a meaningful time frame when evaluating any money manager. It needs to be sufficient enough to accurately provide some evidence that the manager can deliver the specialty that you are seeking. In the field of science, one of the most valuable assets a scientist has is a rich and diverse sample set. Their research peers will very quickly notice the inherent errors in judgement that can occur by using what they refer to as a “statistically insignificant sample size”.

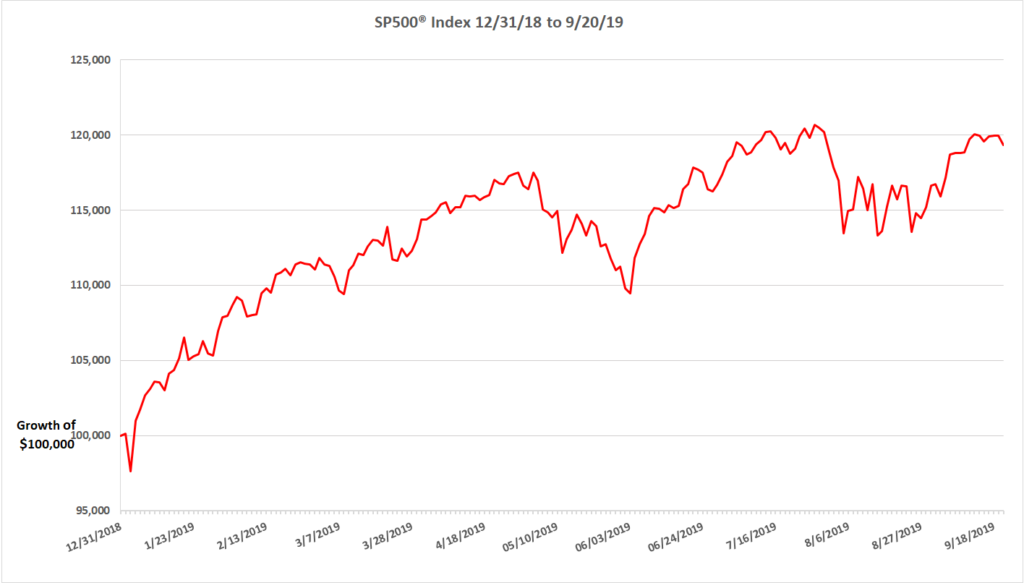

We all can get excited when the markets do well. Lets take the first 8 1/2 months of 2019. The broad US stock market has gone up in all but two months. In fact during this limited time period, it has probably outperformed many investment approaches. The graph below shows the performance of the S&P 500® Index from 12/31/18 to 9/20/19.

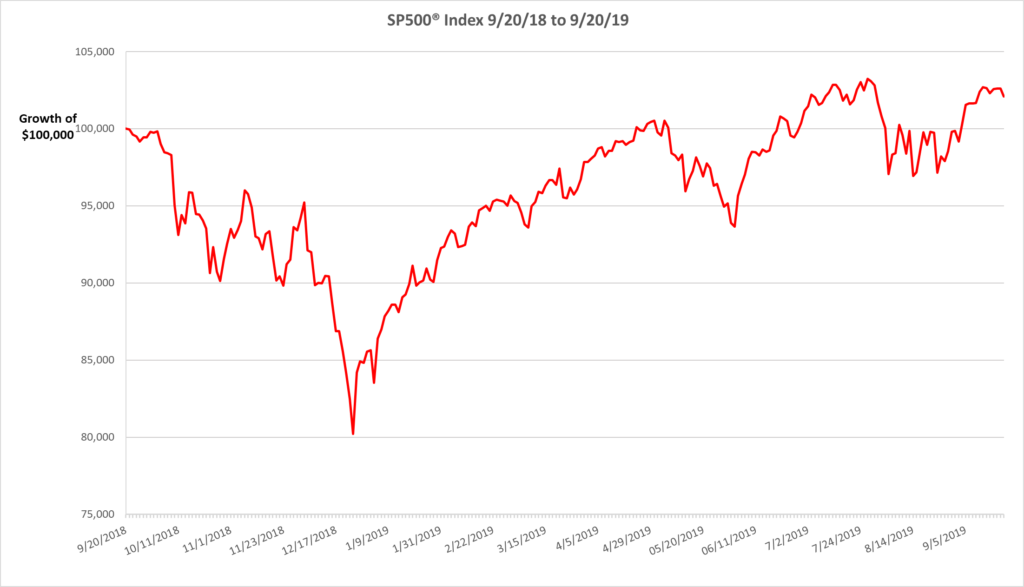

But wasn’t the market due for some type of run up? Are some of the markets gains in 2019 because of how bad it did in 2018? What happens when you step back and widen your focus, looking at a more meaningful time frame? The graph below also shows the performance of the S&P 500® Index, but this time we pull back and include the market high on September 20, 2018.

Now more data points start to give you a better picture of the kind of ride the market had during these 12 months. Do you feel the industry forces you into believing this kind of ride is necessary in order to match or exceed the market returns?

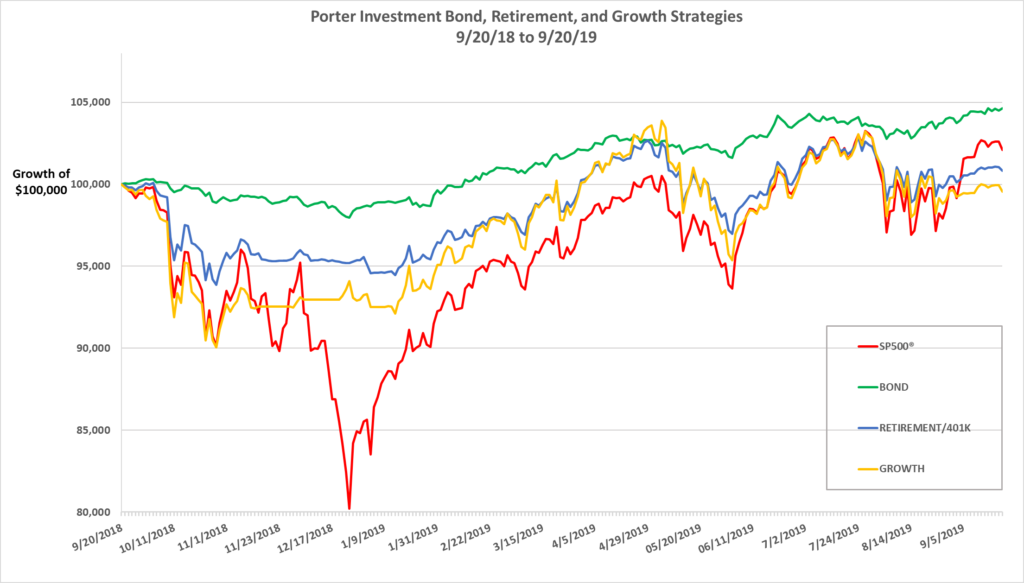

The final graph below shows the Index performance against some of the Porter Investment Strategies for the same one year period, taken from actual tracking account values. When done correctly, smoother rides do not always mean inferior returns.

The only time it is important to capture every single upward move in the market, like in 2019, is when someone did not have the discipline to protect their prior gains when the market corrected, as it did in 2018.

We all strive for market beating returns, but evaluate your investment approaches using meaningful time frames and ask yourself, “What kind of ride do I want?

Think a recession or the next bear market is just around the corner? Schedule a brief 30 minute visit with us or call 713-461-5303. To learn more, take a look at our services including active investing, passive investing, and retirement income planning.

*market cORRECTION IS DEFINED AS A DROP IN THE SP500® INDEX OF APPROXIMATELY 20% OR GREATER

PERFORMANCE IS SHOWN NET OF HIGHEST POSSIBLE MANAGEMENT FEE, YOUR ACTUAL FEE MAY HAVE BEEN LESS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS AND IT SHOULD BE UNDERSTOOD THAT PERFORMANCE RESULTS ARE PROVIDED SOLELY FOR INFORMATIONAL PURPOSES AND ARE NOT TO BE CONSIDERED INVESTMENT ADVICE. THERE ARE INHERENT LIMITATIONS WHEN VIEWING RELATIVE PERFORMANCE IN SHORT TIME PERIODS. THE S&P 500® INDEX IS A MARKET CAPITALIZATION–WEIGHTED INDEX OF 500 WIDELY HELD STOCKS OFTEN USED AS A PROXY FOR THE BROADER STOCK MARKET. S&P 500® IS A REGISTERED TRADEMARK OF STANDARD & POOR’S FINANCIAL SERVICES LLC. ANY REFERENCE TO A MARKET INDEX IS INCLUDED FOR ILLUSTRATIVE PURPOSES ONLY, AS IT IS NOT POSSIBLE TO DIRECTLY INVEST IN AN INDEX.

Please see for DISCLOSURE for additional information.

Bob Porter is the President of Porter Investments. Porter Investments is a fiduciary investment management firm based in Houston, Texas, helping self-directed and hybrid investors gain professional guidance and grow their portfolios with tactical strategies. Bob's prior work at Fidelity Investments allowed him the opportunity to advise and study a diverse group of investors.

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter