In 1952, Ray Bradbury wrote a short sci-fi story about a safari hunter who travels back in time. The hunter pays an outfitter to ride aboard their time machine. The outfitter promises a chance to shoot “the most incredible monster” and provide “the severest thrill a real hunter ever asked for.” The animal was a Tyrannosaurus rex. The time machine quickly passes before 1945, then before the birth of Christianity and Alexander the Great. They eventually arrive sixty million years back in time.

The guide gives him one rule before they get out that he should never question or violate, because the consequences could be too severe and incomprehensible to imagine. He tells them there will be a small, narrow path, hovering 6 inches above the jungle as they exit. It never encounters anything, not even a blade of grass. The rule is – never, ever step off the path.

The guide tells the hunter “We don’t want to change the future. We don’t belong here in the Past”. As an example, the guide explains the possible effects of accidentally stepping off and killing a small mouse. Killing one mouse could prevent dozens, and later thousands, of mice being born. How would that affect the foxes in the future that depend on mice for food? What about the tigers or lions that depend on foxes? And what if cavemen starve due to the lack of lions or tigers that earlier depended on the foxes for food?

The point is one can never know the effects of something that seems totally inconsequential, compounded over millions of years. This has become known as Bradbury’s Butterfly Effect.

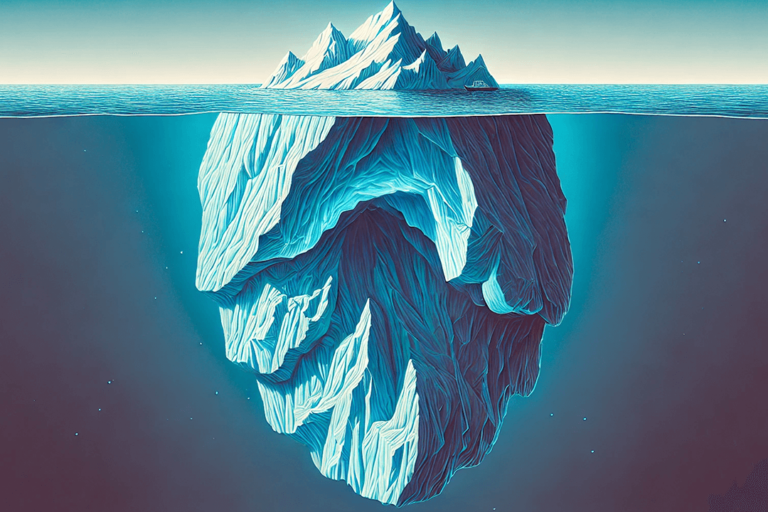

This seemingly fantastical scenario is relevant to the world of investing. In both life and the financial markets, small decisions can lead to major consequences that are impossible to foresee. The interconnectedness of events applies just as much to investment portfolios as it does to the natural world.

Seemingly trivial decisions made by some individuals, subtle shifts in market sentiment, or unforeseen geopolitical events can all ripple through markets, influencing risk and return in ways that are often incomprehensible now.

At first glance you might feel this is not a valid comparison. After all, who has an investment time frame of 1 million years? But think about the millions of investors there are in the stock market. How many different motivations, understandings, and views can they have? How many different reactions can they have to a single event? If you believe that your past experiences shape your reasoning and choices, then what are the odds that the success (or failure) of your investments is dictated 100% by only your choices?

It is incomprehensible for anyone to know ahead of time the net consequence of every decision everyone else makes before we make ours. We were raised in different environments, have multiple views on risk, and varying views on what seems reasonable. We will never know with certainty how everything is interwoven and interconnected.

This is where the core theme of uncertainty emerges. In investing, as in Bradbury’s story, the future is filled with unpredictable outcomes. Understanding how our actions today might impact ours, or other people’s long-term plans can be difficult, if not impossible.

Investment Risk and Uncertainty

Howard Marks, in his reflections on investment risk, often emphasizes the unpredictability of markets, underscoring the importance of recognizing that risk arises from the things we cannot know or predict.

Likewise, Peter L. Bernstein, in his discussions of risk and uncertainty, draws attention to the fact that in financial markets, risk is not just the measurable variance in outcomes but the exposure to unanticipated events.

Humans and Uncertainty

Humans are not naturally wired to accept uncertainty. Our evolutionary instincts drive us to seek safety, predictability, and control things that are often in direct opposition to the volatile and unpredictable nature of investing.

Uncertainty, especially in the financial markets, triggers a deep discomfort because it confronts us with the unknown, something we cannot easily measure or quantify. This inability to quantify uncertainty becomes a significant problem in investing because, unlike volatility, which can be measured through probabilities and historical data – uncertainty operates in the realm of the unforeseeable. It is the uncertainty of future outcomes that makes investing so challenging.

We take risks, often with the belief that we are smart enough to predict or control the future. Whether it’s due to overconfidence or an illusion of control, many investors believe they can outsmart the market, using data and forecasts to minimize uncertainty. But no matter how sophisticated an investment strategy may be, it’s built on assumptions about the future that are inherently unknowable.

Illusion of Control Bias

One of the main reasons this belief is flawed is due to the “illusion of control,” a cognitive bias where people overestimate their ability to influence outcomes that are largely determined by chance.

In both investing and life, we like to believe that by carefully planning, making the right decisions, and preparing for different scenarios, we can predict and control what will happen in the future. However, as history has shown repeatedly, outcomes are often shaped by external factors beyond our control.

Morgan Housel points out in The Psychology of Money that randomness and luck play a significant role in financial success, and overconfidence in one’s ability to control outcomes often leads to unexpected and undesirable consequences.

You have heard the most successful athletes’, entertainers, and long-term investors all say that you must “become comfortable with being uncomfortable”. The problem is that most investors, when faced with uncertainty, are tempted to avoid it by sticking to familiar strategies or ignoring risks altogether, hoping things will turn out fine. And in many cases, it does turn out fine.

This can create another, bigger problem. We think that if it turns out fine, then we are really smart. We think we made the right decision because the outcome is what we wanted. We never stop and think about the possibility (luck) that we may have experienced one of the favorable outcomes from a pool of possible outcomes. At any given time, you will never know where you are in the unfolding sequence of events because life does not let you know that ahead of time.

Heuristics in Investing

Are we intellectually lazy when it comes to risk, or is it simply a natural response to uncertainty? The answer is likely a mix of both. The human brain craves shortcuts, known as heuristics, to help make sense of complex information.

In investing, these shortcuts often lead to overconfidence or reliance on past performance as an indicator of future success. We like to believe we can know the future because it simplifies decision-making and gives us a false sense of security. But in reality, we may be avoiding the uncomfortable truth: that we can never fully eliminate uncertainty.

Embracing Uncertainty

So, can humans ever become totally comfortable with being uncomfortable? Perhaps not completely, but we can learn to accept it as part of the investment process. The key to successful investing often lies in embracing uncertainty—not in trying to eliminate it, but in finding strategies that acknowledge its presence while still pursuing long-term goals.

History and financial markets are driven by complexity and randomness. In his writings, James Mackintosh of The Wall Street Journal highlights how the financial world is interconnected in ways that are difficult to fully understand or predict. Seemingly minor or isolated events can have far-reaching consequences (as in Bradbury’s “butterfly effect”), creating outcomes that no one could foresee. This interconnectedness means that while we try to exert control, the sheer complexity of variables involved makes true prediction or control virtually impossible.

The COVID-19 pandemic is a prime example of how unpredictable and interconnected events can be. Few, if any, investors foresaw the pandemic, and it caused seismic shifts in global economies, financial markets, and individual portfolios. Investors who believed they had control over their outcomes were reminded that external, unforeseen factors often drive market movements.

Life, like investing, is inherently uncertain. We may crave control and certainty, but the reality is that much of life is out of our hands.

Diversification of Assets and Thought, Discipline, and Planning

The challenge is to learn to accept this uncertainty rather than fight against it. In investing, this means acknowledging that while we can make informed decisions, we cannot guarantee specific outcomes, nor can we avoid all risks. The best we can do is manage risk through diversification of assets AND of thought, disciplined execution, and long-term planning—knowing that uncertainty is a part of the process.

The belief that we can control future outcomes while recognizing the interconnectedness of events is flawed because it underestimates the complexity and unpredictability of the systems we operate in. It overestimates our ability to influence outcomes and disregards the role of chance, external events, and psychological biases.

True investment success—and perhaps even life success—comes not from attempting to control the future, but from learning to manage uncertainty, adapt to changing conditions, and maintain discipline in the face of unpredictability. By accepting that we cannot fully control outcomes, we are better equipped to focus on the things we can control: our behavior, decision-making process, and risk management strategies

To learn more, take a look at our services, including active investing, passive investing, and retirement income planning.

If you are interested in learning more about investing, get in touch with us today.

Bob Porter is the President of Porter Investments. Porter Investments is a fiduciary investment management firm based in Houston, Texas, helping self-directed and hybrid investors gain professional guidance and grow their portfolios with tactical strategies. Bob's prior work at Fidelity Investments allowed him the opportunity to advise and study a diverse group of investors.

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter