Imagine this: You’re finally retired. You’ve run the numbers, talked to your advisor, and felt confident about your ability to withdraw $10,000 per month from your retirement savings. The plan says it’s enough. You’ll be fine for 35 years – as long as inflation stays at 3%, the historical average over the past 100 years. So, you settle into your new rhythm, take the occasional trip, help the kids when needed, and enjoy the freedom you worked so hard for.

But then something unexpected happens, and inflation doesn’t stay at 3%. It surges to 6%. Then drops. Then, it spikes again. Groceries are more expensive. Gas prices sting. Healthcare premiums climb. Suddenly, that $10,000 doesn’t stretch as far—and the cushion you thought you had starts to shrink. The plan didn’t break in one big moment. It slowly wore thin.

That’s the hidden danger of planning with a fixed inflation assumption: it makes retirement look smoother than it really is.

Here’s the reality—retirement is lived in real time, and inflation shows up in unpredictable ways. Sometimes, it’s early, sometimes late, and sometimes not at all, until it hits hard. And when it does, it’s not just a number on a spreadsheet. It’s a budget cut, a lifestyle shift, a postponed dream, or a tough conversation with a loved one.

Too many financial plans still assume inflation is calm, consistent, and linear. But that’s not what history shows. And it’s not what real retirees experience.

In this post, we’ll unpack why fixed inflation assumptions are failing today’s retirees—and what a more innovative, more flexible planning approach looks like in a world where inflation won’t remain consistent.

The Problem with Fixed Inflation in Financial Planning

Many retirement plans use a fixed inflation rate, usually 2% or 3%, year after year. It makes the projections look neat, clean, and easy to follow. Some plans allow for different inflation levels for specific categories (such as core CPI assumptions and health care inflation assumptions). But they still tend to be fixed over the life of the plan. If your advisor has made a retirement plan for you, then look at the inflation rate in the assumption section. If there is no mention of standard deviation, then it is probably fixed.

But here’s the issue: real-life inflation doesn’t behave that way. And pretending it does can quietly lead retirees into trouble.

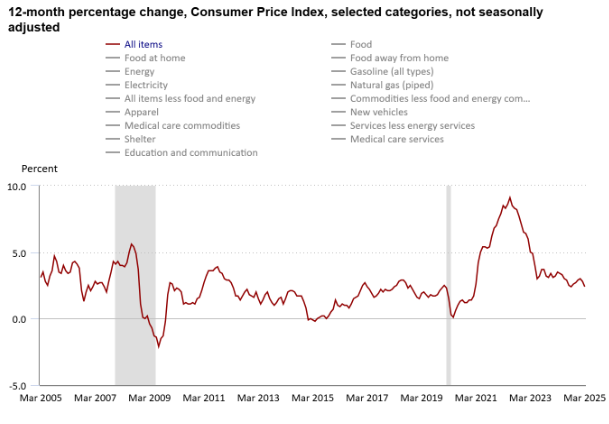

Take a look at the chart below from the Bureau of Labor Statistics.

If you removed the title and the legend on the chart above, you might think it showed the 12-month percentage change in a stock. There is nothing fixed about the change of inflation from one year to the next.

What’s the problem with using fixed inflation?

- It assumes predictability in a world that’s anything but predictable.

- It creates a false sense of security, suggesting your dollars will always lose value slowly and steadily.

- It hides real risk, especially early in retirement, when spending is typically highest.

- It ignores history, where inflation has varied wildly—even within short time frames.

Take the last few years, for example. We’ve seen inflation dip near zero, then spike above 8%. That’s not a gentle 3% slope. It goes up and down like a rollercoaster.

Why does this matter for retirees?

- Retirees often live on fixed or semi-fixed income.

- Spending power is most vulnerable in the early years of retirement.

- Early inflation shocks can permanently reduce long-term financial stability.

It’s like building your retirement plan on the assumption that every day will be sunny. You may be fine for a while—until the storm hits. And by the time it does, the damage can be hard to reverse.

Fixed inflation models may lead to:

- Overconfidence in early retirement spending

- Plans that don’t adapt to real-world price changes

- Unexpected shortfalls later in life

In short, using a fixed rate might make the math easier – but it doesn’t make the plan better. If we want to build plans that hold up in real life, we need to start treating inflation like the unpredictable force it truly is.

Inflation Behaves Like Market Returns—Uncertain and Variable

Think about how you experience returns in the stock market. You know that returns won’t be the same every year. What matters is the long-term trend. That’s baked into every good investment plan. We look at hundreds of possible economic outcomes using Monte Carlo simulations, we look at the variability of returns in different scenarios, and we fully expect there to be ups and downs.

But here’s the irony – we don’t give inflation the same respect.

Inflation is every bit as unpredictable as market returns—sometimes even more so. One year it’s under control, the next it’s climbing at a rate no one saw coming. Just like the market, inflation moves based on forces outside our control: geopolitics, supply chains, energy prices, monetary policy, consumer behavior—you name it. And just like the market, inflation is never linear.

Yet, too often, we still treat it like it is.

In less-advanced planning software, inflation is typically entered as a single, fixed number. That number might differ across spending categories—say, 3% for general expenses, 5% for healthcare—but it’s still locked in, year after year. There is no variance, no sequence risk, and no acknowledgment that retirees will feel those price changes differently depending on when they happen.

But just as there’s a sequence of returns risk – where bad market years early in retirement can derail a portfolio – there’s a sequence of inflation risk, too. And it’s just as dangerous. If inflation is high early on, especially when spending is at its peak, it can permanently shrink a retiree’s future purchasing power.

The problem is that even if average inflation is 3%, the order in which it happens matters. That’s why two retirees can both face 3% average inflation, but one ends up fine while the other struggles—simply because the timing was different.

So, if we’re willing to model market risk with flexibility and nuance, shouldn’t we treat inflation the same?

How Fixed Assumptions Distort Retirement Spending Projections

Let’s say you’ve calculated that you can withdraw $10,000 a month from your investments but it is not adjusted for inflation. On the surface, this doesn’t look too bad. looks like a solid, reliable income stream.

A typical plan assumes a 3% inflation rate and recommends spending about $6,640/month to maintain purchasing power over 30 years.

Sounds smart, right? Here’s the Issue:

When you use actual historical inflation sequences:

- That $6,640/month spending level would have failed in more than half of historical inflation environments.

- To succeed in every historical case, the retiree would need to start with just $4,350/month.

- That’s a gap of over $2,000/month! That difference can have real lifestyle consequences.

This happens because fixed assumptions ignore sequence-of-inflation risk – the idea that when inflation hits matters just as much as how much. The sequence of inflation rate risk is just like the sequence of investment return risk. The fact that an investment “averaged” 12% a year or that inflation averaged 3% a year is unimportant. One of my mentors used to say:“A six-foot man can drown trying to cross a river that averages 3 feet deep”

Here’s how fixed inflation distorts the picture:

- It assumes a smooth path when inflation is often volatile.

- It understates your actual risk of running out of money

- It overstates safe spending early on, especially if inflation surges in the first decade.

- It masks the need for flexibility, and clients only discover the shortfall when it’s too late.

Think of it this way: you’re planning a 30-year retirement journey using GPS that assumes there will be no traffic, no detours, and perfect weather. It’ll get you there if everything goes exactly as planned.

But when does that ever happen?

The takeaway:

- Fixed inflation models simplify the math but oversimplify reality.

- Sequence risk isn’t just a market issue – it applies to inflation, too.

- To build smarter, safer retirement income strategies, we must start modeling inflation dynamically, just like we do with returns.

- One way to reduce the impact of inflation risk in your retirement years is to slightly increase the allocation of stocks. Unfortunately, this is counterintuitive, harder to stick with over time, and flies in the face of the “conventional wisdom” that advises you to continually increase your allocation to bonds as you move through retirement. This could be a big problem for retirees if the inflation of 2022-2025 remains around longer than expected.

Introducing Dynamic Inflation Modeling in Retirement Software

While volatility in market returns is widely accounted for through Monte Carlo simulations and historical stress testing, inflation is still frequently treated as a fixed, deterministic input.

This creates a material disconnect between the planning model and the real-world risks retirees face.

To address this gap, leading planning software platforms have begun integrating dynamic inflation modeling, enabling practitioners to simulate inflation as both uncertain and path-dependent.

There are two primary approaches: (1) Monte Carlo simulations incorporating inflation volatility, and (2) historical inflation sequence analysis.

Monte Carlo models: Planners can assign both a mean inflation rate and a standard deviation, allowing for a distribution of possible future inflation outcomes. This enables more comprehensive “real spending” projections—especially valuable when modeling income sources not tied to cost-of-living adjustments (COLAs), such as nominal pensions, bond ladders, or annuities without inflation protection.

Historical Simulation: Uses actual year-by-year inflation sequences from U.S. history, capturing the sequence-of-inflation risk. This helps to capture the impact of when inflation occurs during retirement. This method directly reflects the volatility retirees might experience and is particularly effective for evaluating worst-case scenarios.

Both approaches allow for a more robust evaluation of risk-adjusted spending strategies, allowing planners to present a range of potential outcomes rather than a single deterministic recommendation. More importantly, they facilitate informed client conversations about risk tolerance, adaptability, and contingency planning.

The key advantage of dynamic inflation modeling lies in its alignment with reality. It helps prevent overconfident spending recommendations based on static assumptions and better equips clients to navigate periods of inflationary stress—especially during early retirement when spending and inflation vulnerability tend to be highest.

Ultimately, integrating variable inflation into retirement models improves analytical rigor and enhances client trust. It replaces fragile optimism with well-grounded, scenario-based resilience—an important step toward more durable financial outcomes.

Your Retirement Plan Shouldn’t Move in a Straight Line

Here’s the big takeaway: inflation doesn’t move in a straight line, and neither should your retirement plan. If you’re using fixed assumptions about inflation, you’re building your future on a shaky foundation—one that might hold up in calm weather but not in a storm.

By planning for a range of inflation outcomes—just like we do for market returns—you give yourself breathing room. Flexibility. Resilience. You’re not hoping things go smoothly; you’re prepared even if they don’t. That’s what real confidence in retirement looks like.

You’ve worked too hard to leave your future to guesswork. A smarter, more thoughtful approach to inflation can make all the difference—not just in your plan but in your peace of mind.

So, let’s stop pretending inflation is predictable. Let’s build plans that reflect how life really works—and give you the tools to thrive, no matter what the future brings. Retirement income planning is like any other investment plan. It comes down to how much risk you want to accept versus how much risk you want to protect yourself against.

Investing is personal. What worked for your neighbor or coworker does not mean it is right for you. Preparation and approaching it with realistic expectations is the key.

Get in Touch With Us

After interviewing and consulting with thousands of investors over the last 25 years, we have found they all eventually fall into the same trap – their investments did not match their expectations, causing an emotional reaction when this occurs. We will present you with a fuller, more reliable expectation picture of your investments. This allows you to confidently navigate down whatever investing path you decide.

Spend a few minutes with us to see if we are a good fit for each other, and see how we can help you craft the perfect retirement income plan.

Bob Porter is the President of Porter Investments. Porter Investments is a fiduciary investment management firm based in Houston, Texas, helping self-directed and hybrid investors gain professional guidance and grow their portfolios with tactical strategies. Bob's prior work at Fidelity Investments allowed him the opportunity to advise and study a diverse group of investors.

- Bob Porterhttps://porterinv.com/our-thoughts/author/bob-porter/

- Bob Porterhttps://porterinv.com/our-thoughts/author/bob-porter/

- Bob Porterhttps://porterinv.com/our-thoughts/author/bob-porter/

- Bob Porterhttps://porterinv.com/our-thoughts/author/bob-porter/