Retirement planning is one of the most important financial decisions you’ll ever make. Many financial plans make assumptions about longevity, but planning for an excessively long life can lead to unnecessary underspending, while underestimating lifespan can result in financial shortfalls. Three important risks center around:

- Investment Risk – The variability of market returns can impact retirement income.

- Inflation Risk – The purchasing power of money may decline, and failure to account for inflation properly can lead to financial strain.

- Longevity and Mortality Risk – The uncertainty of lifespan impacts how retirement assets should be managed.

The important questions focus on longevity risk (outliving resources) and mortality risk (one spouse dying earlier than expected and reducing household income). These two risks create a dilemma in retirement planning.

How Long Should I Plan For Retirement?

If you underestimate your lifespan, you risk running out of money. If you overestimate, you might live too frugally and miss out on enjoying your wealth.

Most financial plans default to assuming a 30-year retirement, with a fixed lifespan to age 90 or 95. However, this one-size-fits-all approach can create financial risks. A smarter strategy considers longevity risk, mortality risk, and retirement income sustainability.

In this comprehensive guide, we will go over:

- How long people are living today (historical trends in life expectancy)

- The risks of outliving your savings (longevity risk)

- The financial impact of losing a spouse early (mortality risk)

- The best strategies for a sustainable retirement income

- Common retirement planning mistakes to avoid

By the end, you’ll be better equipped to plan for a retirement that lasts, without overspending or underspending.

How Long Do People Live? Understanding Life Expectancy Trends

To plan retirement correctly, you must first understand how long people live today.

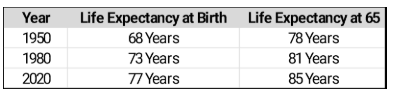

Life Expectancy Over The Last Century

In 1900, the average life expectancy at birth in the U.S. was 47 years. As of 2020, it’s nearly 80 years.

More importantly, life expectancy increases as you age.

Please keep in mind these are averages, but if you’re 65 today, you have a 50% chance of living to 85.

- A 65-year-old couple has a 50% chance that at least one spouse will live past 90.

- 25% of 65-year-olds will live to 95 or beyond.

To put this in perspective, consider the individual who was 65 in 2020. They were born in 1955. In 1955, their life expectancy was probably a little over 68 years. Now, at age 65, their life expectancy is 85 years, 17 years longer on average.

This data proves that planning retirement to 95 is not extreme – it’s realistic for many people.

Why Traditional Life Expectancy Assumptions Fail

Most retirement plans use a fixed life expectancy, usually age 90 or 95, to determine how long income needs to last. While this seems safe and conservative, it often leads to oversimplification, rigid planning, and missed opportunities.

Retirement isn’t a one-time calculation. Life expectancy isn’t a single number. It’s a moving target that changes as you age and as your circumstances evolve. Just as investment plans are regularly reviewed and updated, your retirement timeline should also adjust based on real-life developments: health status, medical advances, family history, and lifestyle changes.

For example, if you’re 65 today and healthy, the fact that you’ve already reached 65 improves your odds of reaching 85, 90, or beyond. But most traditional plans never revisit that assumption. They set it and forget it. The result? Retirees either underspend out of fear or overspend by assuming too much certainty.

Here’s why fixed life expectancy assumptions fall short:

- Life expectancy increases with age. If you make it to age 70, your life expectancy is no longer 85; it has increased. Fixed models ignore this progression.

- Health and lifestyle play a major role. Non-smokers, physically active individuals, and those with healthy diets typically outlive the averages. A 65-year-old in excellent health could easily live 25 to 30 more years.

- Family history matters. If your parents and grandparents lived into their 90s, your personal odds of longevity are higher than average. This nuance is rarely reflected in traditional plans.

- Higher income and education correlate with longer life. Studies show that individuals in the top income quintiles live significantly longer than those in lower ones. Yet most life expectancy assumptions are based on general population averages.

- Static planning ignores medical and technological advancements. Innovations in medicine, diagnostics, and treatments extend lifespans. A fixed plan doesn’t account for progress that may add years to your life.

- Psychological behavior skews decision-making. When clients see a retirement plan that ends at age 90, they subconsciously think of it as a finish line. That can distort spending behavior by either being too cautious or too reckless.

To improve accuracy and confidence, your retirement plan should treat life expectancy as a dynamic probability, not a static endpoint.

The Two Biggest Retirement Risks: Longevity vs. Mortality

Longevity Risk: What If I Live Too Long?

One of the most overlooked dangers in retirement planning is the longevity risk, which is the risk of living longer than expected and running out of money as a result. While it may seem like a “good problem to have,” it can be financially devastating if not planned for correctly.

Many retirees assume they’ll live into their 80s and base their savings and withdrawal strategy accordingly. But the truth is, you could live 10 to 15 years longer than expected, especially with improvements in healthcare and genetics working in your favor. Without a flexible, sustainable income strategy, these extra years can put serious stress on your portfolio.

This is, by far, the biggest concern we see with investors nearing retirement.

Example: Jane’s Retirement Plan

- Jane, 65, retires with $3.5 million in savings.

- She plans for a 30-year retirement (to age 95).

- She withdraws $120,000 per year from her IRAs to help cover expenses.

- If she lives beyond 95, she could run out of money.

The problem? Jane doesn’t know if she’ll live to 75 or 105.

A 30-year retirement is no longer rare. If your plan only anticipates 20 to 25 years, you could deplete your resources just when you need them most. Rigid rules like the 4% rule don’t adapt to changing circumstances. The longer you live, the more likely you’ll need expensive care, often not covered by Medicare. Even modest inflation can significantly negatively impact purchasing power over 30+ years, especially if your income sources aren’t inflation-adjusted. Living into your 90s increases the likelihood of cognitive issues that could impair decision-making or increase your vulnerability to financial mistakes or fraud. Without a strategy for managing income later in life, retirees often face tough choices, like selling assets or reducing lifestyle, at the worst possible time. Longer lifespans require more dynamic, personalized approaches.

Many retirees err on the side of caution, spending too little early in retirement out of fear. This leads to regret risk, where retirees miss out on travel, hobbies, and experiences they could afford.

Mortality Risk: What If I Die Too Soon?

While longevity risk gets most of the attention, mortality risk is just as important, especially for couples. This is the risk that one spouse dies earlier than expected, and the surviving spouse is left with reduced income but similar living expenses.

Most retirement plans focus on sustaining income for a long life, but they often overlook what happens when one partner dies early. When that happens, a household can lose a Social Security check, part (or all) of a pension, and shift into a less favorable tax bracket, even though many fixed expenses remain.

Without careful planning, the surviving spouse may face a sharp decline in income, increased taxes, and emotional stress at once. Here’s why this risk is often underestimated:

- Loss of Social Security income.

When one spouse passes away, the survivor keeps the larger of the two benefits, but the smaller one disappears, often cutting total Social Security income by 25–40%. - Pension income may end or be reduced.

If a retiree chose a single-life pension, those payments stop at death. Even joint-life pensions often pay a reduced amount to the survivor. - Household expenses don’t drop proportionally.

While food and travel might decrease, housing, utilities, healthcare, and insurance usually remain similar, sometimes even increasing with age. - Surviving spouses move into a higher tax bracket.

Filing status changes from married filing jointly to single, which can result in higher taxes on the same income. - Unexpected financial strain during grief.

Dealing with a spouse’s death is already difficult. Adding financial instability can amplify stress and complicate important decisions. - Risk of being forced to draw more from investments.

To make up for the loss of guaranteed income, the survivor may need to withdraw more from the portfolio, increasing the chance of depletion.

Example: John and Mary’s Income Decline

- John and Mary, both 65, rely on:

- $5,000 per month from Social Security and pensions.

- A $1,8 million investment portfolio.

- If John dies at 75, Mary could lose $2,000 per month in income.

- Her taxes may increase because she moves from joint filing to single filing.

Addressing mortality risk means thinking beyond just “how long will our money last?” It requires building a plan that protects both spouses, so the survivor can maintain financial independence and quality of life, even after an unexpected loss.

Here’s how to protect yourself and your loved ones:

- Incorporate mortality-adjusted income planning.

Adjust income projections to reflect the possibility that one spouse may pass away earlier, reducing Social Security or pension income. Don’t assume both checks will continue for 30 years. - Use joint-life options for pensions and annuities.

Choosing a joint-and-survivor payout for pensions and annuities can help maintain household income for the surviving spouse, even if it reduces the initial benefit. - Plan for the surviving spouse’s tax situation.

Account for the higher tax brackets the survivor may face and how that could affect net income. Adjust distributions and withholdings accordingly. - Stress-test different life expectancy scenarios.

Run retirement projections that include both long life spans and early deaths to understand how different timelines impact income sustainability. - Consider permanent life insurance.

For couples with significant pension income or legacy goals, life insurance can help replace lost income and provide financial support for the surviving spouse. - Prioritize flexible withdrawal strategies.

Instead of rigid rules, use a dynamic withdrawal approach that allows you to adjust spending based on changes in health, portfolio performance, and life events. - Regularly review and update your plan.

Revisit your retirement plan at least annually to reflect new life expectancy projections, income sources, and personal or family changes.

With the right strategies in place, you can build a retirement income plan that balances growth and security—and most importantly, respects the reality that life doesn’t follow a script.

The best retirement income strategies balance both risks.

Common Retirement Planning Mistakes to Avoid

Even the most well-intentioned retirees can fall into traps that derail an otherwise solid retirement strategy. With so many moving parts—markets, inflation, taxes, healthcare costs, and life expectancy- retirement income planning requires more than just plugging numbers into a calculator. Often, people lean too heavily on simplistic rules of thumb or outdated assumptions that don’t reflect their personal situation or today’s economic realities.

Many retirement mistakes stem from either too much rigidity or not enough structure. Some retirees fear running out of money so much that they live too conservatively, sacrificing quality of life. Others overestimate the reliability of their income sources or assume their costs will decline dramatically over time. And many forget to update their plan as life changes, which is important when retirement can stretch across decades.

Avoiding these common missteps can make the difference between a retirement filled with stress and one filled with freedom. Here are the top mistakes to watch out for:

1. Over-Relying on the 4% Rule

While the 4% rule is a useful starting point, it’s based on historical averages, not your personal risk tolerance, market conditions, or changing expenses. Rigid withdrawal rates can lead to either overspending or underspending, especially in volatile markets.

2. Assuming Expenses Will Drop Significantly in Retirement

While work-related costs may disappear, many core expenses, such as housing, healthcare, insurance, and travel, often remain steady or even rise. Don’t plan on cutting your budget in half just because you’re no longer working.

3. Ignoring Healthcare and Long-Term Care Costs

Healthcare is one of the biggest and most underappreciated expenses in retirement. Fidelity estimates a 65-year-old couple will need over $300,000 for medical expenses. And that doesn’t include long-term care, which can cost $100,000+ annually.

4. Failing to Diversify Income Sources

Relying too heavily on Social Security or portfolio withdrawals alone can be risky. A strong retirement plan includes multiple income streams: Social Security, pensions, annuities, investments, and possibly part-time work or rental income.

5. Not Factoring in Taxes on Retirement Income

Many retirees assume their tax burden will drop, but that’s not always the case. Required Minimum Distributions (RMDs), Social Security taxes, and capital gains can all drive unexpected tax bills, especially for those in higher income brackets.

6. Neglecting to Plan for a Surviving Spouse

Losing a spouse often means losing income, facing higher tax brackets, and dealing with financial decisions alone. Too few plans fully account for the financial impact of widowhood.

7. Failing to Revisit and Adjust the Plan

Markets change. Health changes. Goals change. Yet too many retirees treat their retirement plan as static. A successful plan should be reviewed annually and adjusted as life unfolds.

Avoiding these pitfalls doesn’t require perfection, just awareness and a commitment to revisit your plan often. Smart retirement planning isn’t about having all the answers on day one, it’s about staying flexible and informed along the way.

Conclusion: The Best Retirement Plans Are Flexible

So, how long should you plan for retirement? The answer isn’t one fixed number, it’s a dynamic, evolving strategy.

- Plan for longevity but adjust spending over time.

- Protect a surviving spouse by accounting for lost income.

- Use a mix of income sources, including annuities and investments.

- Update your plan annually based on new longevity data.

Remember, investing is personal. What worked for your neighbor or coworker does not mean it is right for you. Before making any changes, preparation and approaching it with realistic expectations are key. After interviewing and consulting with thousands of investors over the last 25 years, we have found that they all eventually fall into the same trap – their investments did not match their expectations, causing an emotional reaction when this occurs. We will present you with a fuller, more reliable expectation picture of your retirement and investments. This allows you to confidently navigate down whatever investing path you decide.

Spend a few minutes with us to see if we are a good fit for each other.

Bob Porter is the President of Porter Investments. Porter Investments is a fiduciary investment management firm based in Houston, Texas, helping self-directed and hybrid investors gain professional guidance and grow their portfolios with tactical strategies. Bob's prior work at Fidelity Investments allowed him the opportunity to advise and study a diverse group of investors.

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter

- Bob Porter