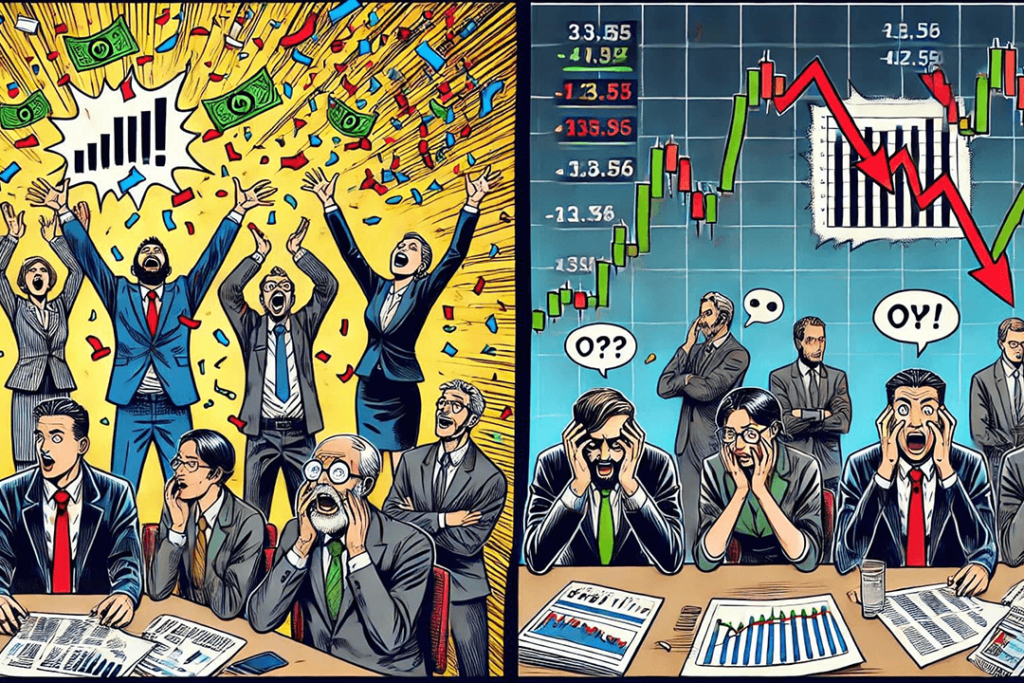

What You Need to Know About the Psychology of a Market Cycle

The stock market is a complex and dynamic system, influenced not only by economic fundamentals but also by the emotions and behavior of market participants.

Strategic Versus Tactical Asset Allocation

Managing investments involves dividing your money among different asset classes like stocks and bonds. This practice, known as asset allocation, helps investors balance risk with potential returns.

Are You an Honest DIY Investor?

If you have been fortunate to build some savings, you will soon face a decision.

You, or somebody you trust, will need to manage your money.

Stock Market Predictions for 2024

As we embark on 2024, please read and carefully consider something I read in the Wall Street Journal.

Why Does the Stock Market Go Up and Down?

When markets are flying up and down like they’ve been doing, the last thing you want to hear is “You need to think long term”. Sometimes we need more than trite expressions, even if there is an underlying truth to our first-thought answers.

Approach Investing Like you Approach a Golf Swing

Even if you are not an avid golfer, one look at this picture and you know certain things. One, you see a water hazard to the right of the green.

The Biggest Fib Your Financial Advisor Will Tell You

When I was a kid one of my favorite questions was “What do you want to be when you grow up?”. It allowed me to dream, based upon what I wanted at that time.

Is “Buy and Hold” the Best Investment Strategy?

We have heard the term “buy and hold” investing is good and market timing is bad. Before we think about this too much, it is important to accurately define what we mean.

Why is it Important to Widen Your Investment Focus?

Many of our clients work with more than one money manager. Each manager may bring a specialty and focus to a particular area of their portfolio.

Five for Friday – July 12, 2019

A regular quarterly report form JP Morgan that is always packed with great charts, tables, and graphs showing what the financial markets are doing.