Quadruple Bottom Pattern – What You Need to Know

If you’ve studied price charts looking for clues, you know that markets don’t speak in words – they tend to speak in repetition and patterns. They are driven by Psychology. When the same price support level holds again and again, it may be the market is quietly insisting on something. And when it happens four times? That’s where the quadruple bottom pattern may be taking shape. The quadruple bottom is one of the rarest chart patterns in technical analysis. And its rarity is exactly what makes it worth understanding. Think of it like four failed jailbreaks: the sellers keep pounding on the same support level, but it holds firm. Each bounce builds confidence that maybe, just maybe, this is the floor. That may be a reversal pattern is unfolding. There’s also an emotional advantage in recognizing it. Traders who have been burned by false breakouts in the past may finally regain conviction when they see this pattern unfold consistently. This is not just a technical pattern; it’s a signpost of conviction, uncertainty, and change in behavior by buyers and sellers alike. That conviction doesn’t arise in isolation. It builds over time as the market refuses to break lower. Each touch reinforces a collective belief among participants that a new floor is in place. It becomes a self-fulfilling foundation where enough believers make it real. Why Understanding the Quadruple Bottom Pattern Matters: Recognizing the bottom pattern early can provide a strong risk/reward setup. It builds upon the principles of the double bottom and triple bottom patterns, but with more conviction. It signals a potential change in price action after prolonged consolidation. It helps investors regain confidence in uncertain market conditions. It acts as a visual story of market resilience and price defense. It builds confidence in long-term market support zones. It can signal institutional accumulation at the lows. I. Defining the Quadruple Bottom The quadruple bottom is a technical analysis chart pattern that occurs when a stock or asset tests a specific price support level or area four separate times without falling below it. This creates a flat base with multiple attempts to break that level, followed by a potential upward breakout. Unlike its cousins—the double bottom and triple bottom patterns—this formation suggests even stronger market resilience. The more times a level is tested and holds, the more significant it becomes. Buyers and sellers engage in a quiet tug-of-war, and the support line becomes the psychological battlefield. It’s not always clean. The lows might deviate slightly. Sometimes it looks like a sideways mess. But patterns don’t need perfection to work, they just need persistence. Importantly, the quadruple bottom does not function in a vacuum. It must be considered alongside broader technical and fundamental contexts. Is volume supporting the price floor? Are macroeconomic events influencing behavior? These questions deepen your understanding of the pattern’s potential. Like any chart pattern, confirmation and risk management are important. The more context you gather—volume analysis, trend strength, sentiment shifts- the more clarity you bring to your decision-making process. II. Understanding the Formation Process Most quadruple bottom formations begin after a market has been trending lower or trading sideways. The first touch usually follows a drop. What follows is hesitation. Attempts for a market rally fade. Sellers push down again—but this time, it doesn’t go further. And again. And again. In between these dips, the price rebounds slightly, creating a resistance level above the support zone. This price band or range, with repeated bottoms and muted tops, creates a coiled spring. Fewer sellers step in. More buyers accumulate. Price compresses. Tension builds. The final act? A price break to the upside that confirms the pattern. Each bounce off a support level is more than just a line on the chart. It is a decision by traders to hold firm or add to positions. Over time, these actions reflect a consensus that the price is undervalued. As the fourth touch holds, confidence swells, and sellers lose resolve. It’s this psychological escalation that makes the pattern so potent. The formation’s timing also matters. If it develops over weeks or months, the implications for a breakout can be far more significant. Time compression builds pressure—and with it, the strength of any move that follows. III. The Mentalities That Drive Quadruple Bottoms Price charts are just pictures of people’s decisions. And when you see a quadruple bottom, you’re seeing an indecision shift toward conviction. Each failed attempt to push below support creates cracks in seller confidence. On the other side of the trades, the buyers get braver; they see value. They know that others see value, too. The market begins to rotate from fear to curiosity to optimism. Buyers begin to act more quickly. Sellers get tired. And before long, the buyers and sellers who were locked in a stalemate begin to tip the scale. Market psychology is a key driver here. The longer prices are held at the support level, the more likely new institutional or retail investors begin to view it as a floor. That accumulation stage often becomes the seedbed for explosive price movements once resistance breaks. You aren’t just trading lines or trading levels, you’re trading behavior. This transition from skepticism to belief can be observed in market sentiment, news coverage, and even social media chatter. Once enough participants believe a bottom is forming, their actions drive the pattern to its final phase: the breakout. IV. Confirmation Methods: Volume & Technical Indicators A pattern is just a pattern until something confirms it. That’s where volume and indicators come in. Technical analysis gives us tools to help separate real breakouts from fake ones. Start with volume: if the price breaks the resistance level on a volume spike, it may mean more people are coming on board. At the very least, you may have more conviction with the existing holders. If indicators like RSI or MACD also diverge from price action during the lows, it signals weakening downside momentum. You can add other moving averages or Bollinger Bands

The All-Weather Portfolio – What You Need to Know

If you could build an investment portfolio designed to weather any storm – economic booms (2021), busts (2008, 2020), inflationary spikes (2022), and deflationary drops (2015), wouldn’t you want to know how it works? That’s the idea behind Ray Dalio’s All-Weather Portfolio. Born out of decades of extensive research and market observation and built on the principles of risk parity and economic cycles, this strategy aims to create a diversified portfolio that performs reliably across the four economic seasons that Dalio identifies: rising growth, falling growth, rising inflation, and falling inflation. It does not try to predict what’s next. Instead, it attempts to prepare for almost anything. I. Why the All-Weather Portfolio Matters Markets aren’t linear. We live through booms and busts, tech bubbles and housing crashes, deflationary recessions, and inflationary shocks. Social media can accelerate our fear and sentiments surrounding these events. Traditionally balanced portfolios, like the classic 60/40 split between stocks and bonds, worked well at certain times, particularly during the disinflationary periods. But what happens when inflation rises or stays elevated? Or, when growth falters? Or both? This is where Ray Dalio’s approach makes a difference. Instead of basing an approach on historical averages or market forecasts, the All-Weather Portfolio was designed to survive and thrive in any economic environment. It acknowledges something that most investors overlook: the future is uncertain and surprises are inevitable. Major moves in the markets do not come from what people are expecting. They come from the unexpected, those events that were not on anyone’s radar. Economic shifts, policy changes, geopolitical tensions, these are things that can’t be continually forecasted with confidence. The 2025 Tariff tantrum is a great example. The All-Weather Portfolio isn’t about trying to be right more often. It’s about being prepared even when you’re wrong. In this way, it gives investors a practical tool to reduce emotional decision-making and avoid panic-driven mistakes during a bear market. The strategy also offers peace of mind for those nearing retirement or managing generational wealth, where preservation is as important as growth. In uncertain times, confidence comes from knowing your portfolio isn’t betting on any one outcome. It’s balanced for all of them. II. The Philosophy Behind the All-Weather Strategy Ray Dalio, founder of the hedge fund Bridgewater Associates, asked a deceptively simple question: What kind of portfolio would perform well across all environments? Rather than trying to outguess the market or the economy, Dalio focused on preparing for the full range of possibilities. His experience taught him that major market moves are often triggered by surprises—events that fall outside of investors’ expectations. These can’t be timed, but they can be prepared for. Dalio’s approach to economic analysis led him to identify the fundamental drivers of asset prices: changes in growth and inflation. By structuring a portfolio that is indifferent to any one economic scenario, investors are no longer beholden to the swings of a single market or asset class. This is a strategy rooted in humility and acknowledging that even the best forecasters are frequently wrong. Many people may start managing some of their investments with little humility, but reality always finds a way to provide you with more. This approach helps to make that process less painful. The result is a framework that distributes risk evenly across the different economic seasons, ensuring that no single event can dominate the outcome. This isn’t just about diversification, it is about intelligent, scenario-based diversification. Dalio and his team broke the economy down into four possible “seasons” or economic environments: Rising growth (economic expansion) Falling growth (recession) Rising inflation (1970s-style inflation shocks, mid-2020’s?) Falling inflation (deflationary slowdowns) By spreading investments across assets that do well in each of these, and balancing risks, you create a portfolio built for any weather. III. Understanding Risk Parity Most investors are familiar with the idea of diversifying a portfolio by mixing different asset classes. But diversification by asset type isn’t enough. The All-Weather Portfolio uses a more advanced idea called risk-parity, which focuses not on how much money is invested in each asset, but on how much risk each one contributes to the portfolio. In a traditional 60/40 portfolio, for instance, even though bonds make up 40% of the capital allocation, most of the risk, which can be more than 90%, can come from the 60% invested in stocks. That’s because stocks are significantly more volatile than bonds. This means that the portfolio’s fate still heavily depends on how equities perform. Risk parity aims to equalize the risk contribution of each asset class. That often requires allocating more money to lower-volatility assets like long-term bonds and less to high-volatility ones like equities. When risks are balanced this way, the portfolio becomes more resilient. Instead of riding the highs and lows of a single asset, it reacts more smoothly to different market conditions. This approach also allows for the use of leverage in some cases, particularly with low-risk assets, to help improve returns without increasing volatility beyond acceptable limits. Risk parity doesn’t eliminate risk; it redistributes it in a more intentional and structured way. IV. The Core Components of the All-Weather Portfolio At the heart of the All-Weather Portfolio are five key asset classes, each chosen for its ability to perform well under specific economic conditions. This isn’t just about picking investments that “diversify” on paper. Each component has been deliberately selected to fill a particular role as the economy cycles through its normal phases – some shine when the economy grows, others when it contracts, and others still when inflation unexpectedly spikes. The main benefit of this approach is that it can work without requiring any forecast. We have nothing against forecasters, and we all need to plan. But it can become a problem when we rely on a forecast to make an investment decision. We may desperately want a forecast to turn out true, but at the end of the day, it might not matter. These assets are combined in such a way that no matter

Fixed Inflation Assumptions Are Failing Retirees—Here’s a Smarter Way to Plan

Imagine this: You’re finally retired. You’ve run the numbers, talked to your advisor, and felt confident about your ability to withdraw $10,000 per month from your retirement savings. The plan says it’s enough. You’ll be fine for 35 years – as long as inflation stays at 3%, the historical average over the past 100 years. So, you settle into your new rhythm, take the occasional trip, help the kids when needed, and enjoy the freedom you worked so hard for. But then something unexpected happens, and inflation doesn’t stay at 3%. It surges to 6%. Then drops. Then, it spikes again. Groceries are more expensive. Gas prices sting. Healthcare premiums climb. Suddenly, that $10,000 doesn’t stretch as far—and the cushion you thought you had starts to shrink. The plan didn’t break in one big moment. It slowly wore thin. That’s the hidden danger of planning with a fixed inflation assumption: it makes retirement look smoother than it really is. Here’s the reality—retirement is lived in real time, and inflation shows up in unpredictable ways. Sometimes, it’s early, sometimes late, and sometimes not at all, until it hits hard. And when it does, it’s not just a number on a spreadsheet. It’s a budget cut, a lifestyle shift, a postponed dream, or a tough conversation with a loved one. Too many financial plans still assume inflation is calm, consistent, and linear. But that’s not what history shows. And it’s not what real retirees experience. In this post, we’ll unpack why fixed inflation assumptions are failing today’s retirees—and what a more innovative, more flexible planning approach looks like in a world where inflation won’t remain consistent. The Problem with Fixed Inflation in Financial Planning Many retirement plans use a fixed inflation rate, usually 2% or 3%, year after year. It makes the projections look neat, clean, and easy to follow. Some plans allow for different inflation levels for specific categories (such as core CPI assumptions and health care inflation assumptions). But they still tend to be fixed over the life of the plan. If your advisor has made a retirement plan for you, then look at the inflation rate in the assumption section. If there is no mention of standard deviation, then it is probably fixed. But here’s the issue: real-life inflation doesn’t behave that way. And pretending it does can quietly lead retirees into trouble. Take a look at the chart below from the Bureau of Labor Statistics. If you removed the title and the legend on the chart above, you might think it showed the 12-month percentage change in a stock. There is nothing fixed about the change of inflation from one year to the next. What’s the problem with using fixed inflation? It assumes predictability in a world that’s anything but predictable. It creates a false sense of security, suggesting your dollars will always lose value slowly and steadily. It hides real risk, especially early in retirement, when spending is typically highest. It ignores history, where inflation has varied wildly—even within short time frames. Take the last few years, for example. We’ve seen inflation dip near zero, then spike above 8%. That’s not a gentle 3% slope. It goes up and down like a rollercoaster. Why does this matter for retirees? Retirees often live on fixed or semi-fixed income. Spending power is most vulnerable in the early years of retirement. Early inflation shocks can permanently reduce long-term financial stability. It’s like building your retirement plan on the assumption that every day will be sunny. You may be fine for a while—until the storm hits. And by the time it does, the damage can be hard to reverse. Fixed inflation models may lead to: Overconfidence in early retirement spending Plans that don’t adapt to real-world price changes Unexpected shortfalls later in life In short, using a fixed rate might make the math easier – but it doesn’t make the plan better. If we want to build plans that hold up in real life, we need to start treating inflation like the unpredictable force it truly is. Inflation Behaves Like Market Returns—Uncertain and Variable Think about how you experience returns in the stock market. You know that returns won’t be the same every year. What matters is the long-term trend. That’s baked into every good investment plan. We look at hundreds of possible economic outcomes using Monte Carlo simulations, we look at the variability of returns in different scenarios, and we fully expect there to be ups and downs. But here’s the irony – we don’t give inflation the same respect. Inflation is every bit as unpredictable as market returns—sometimes even more so. One year it’s under control, the next it’s climbing at a rate no one saw coming. Just like the market, inflation moves based on forces outside our control: geopolitics, supply chains, energy prices, monetary policy, consumer behavior—you name it. And just like the market, inflation is never linear. Yet, too often, we still treat it like it is. In less-advanced planning software, inflation is typically entered as a single, fixed number. That number might differ across spending categories—say, 3% for general expenses, 5% for healthcare—but it’s still locked in, year after year. There is no variance, no sequence risk, and no acknowledgment that retirees will feel those price changes differently depending on when they happen. But just as there’s a sequence of returns risk – where bad market years early in retirement can derail a portfolio – there’s a sequence of inflation risk, too. And it’s just as dangerous. If inflation is high early on, especially when spending is at its peak, it can permanently shrink a retiree’s future purchasing power. The problem is that even if average inflation is 3%, the order in which it happens matters. That’s why two retirees can both face 3% average inflation, but one ends up fine while the other struggles—simply because the timing was different. So, if we’re willing to model market risk with flexibility and nuance, shouldn’t we

How Long Should I Plan for Retirement? A Guide to Secure Retirement Income Planning

Retirement planning is one of the most important financial decisions you’ll ever make. Many financial plans make assumptions about longevity, but planning for an excessively long life can lead to unnecessary underspending, while underestimating lifespan can result in financial shortfalls. Three important risks center around: Investment Risk – The variability of market returns can impact retirement income. Inflation Risk – The purchasing power of money may decline, and failure to account for inflation properly can lead to financial strain. Longevity and Mortality Risk – The uncertainty of lifespan impacts how retirement assets should be managed. The important questions focus on longevity risk (outliving resources) and mortality risk (one spouse dying earlier than expected and reducing household income). These two risks create a dilemma in retirement planning. How Long Should I Plan For Retirement? If you underestimate your lifespan, you risk running out of money. If you overestimate, you might live too frugally and miss out on enjoying your wealth. Most financial plans default to assuming a 30-year retirement, with a fixed lifespan to age 90 or 95. However, this one-size-fits-all approach can create financial risks. A smarter strategy considers longevity risk, mortality risk, and retirement income sustainability. In this comprehensive guide, we will go over: How long people are living today (historical trends in life expectancy) The risks of outliving your savings (longevity risk) The financial impact of losing a spouse early (mortality risk) The best strategies for a sustainable retirement income Common retirement planning mistakes to avoid By the end, you’ll be better equipped to plan for a retirement that lasts, without overspending or underspending. How Long Do People Live? Understanding Life Expectancy Trends To plan retirement correctly, you must first understand how long people live today. Life Expectancy Over The Last Century In 1900, the average life expectancy at birth in the U.S. was 47 years. As of 2020, it’s nearly 80 years. Source: CDC, Social Security Administration, mortality.org More importantly, life expectancy increases as you age. Please keep in mind these are averages, but if you’re 65 today, you have a 50% chance of living to 85. A 65-year-old couple has a 50% chance that at least one spouse will live past 90. 25% of 65-year-olds will live to 95 or beyond. To put this in perspective, consider the individual who was 65 in 2020. They were born in 1955. In 1955, their life expectancy was probably a little over 68 years. Now, at age 65, their life expectancy is 85 years, 17 years longer on average. This data proves that planning retirement to 95 is not extreme – it’s realistic for many people. Why Traditional Life Expectancy Assumptions Fail Most retirement plans use a fixed life expectancy, usually age 90 or 95, to determine how long income needs to last. While this seems safe and conservative, it often leads to oversimplification, rigid planning, and missed opportunities. Retirement isn’t a one-time calculation. Life expectancy isn’t a single number. It’s a moving target that changes as you age and as your circumstances evolve. Just as investment plans are regularly reviewed and updated, your retirement timeline should also adjust based on real-life developments: health status, medical advances, family history, and lifestyle changes. For example, if you’re 65 today and healthy, the fact that you’ve already reached 65 improves your odds of reaching 85, 90, or beyond. But most traditional plans never revisit that assumption. They set it and forget it. The result? Retirees either underspend out of fear or overspend by assuming too much certainty. Here’s why fixed life expectancy assumptions fall short: Life expectancy increases with age. If you make it to age 70, your life expectancy is no longer 85; it has increased. Fixed models ignore this progression. Health and lifestyle play a major role. Non-smokers, physically active individuals, and those with healthy diets typically outlive the averages. A 65-year-old in excellent health could easily live 25 to 30 more years. Family history matters. If your parents and grandparents lived into their 90s, your personal odds of longevity are higher than average. This nuance is rarely reflected in traditional plans. Higher income and education correlate with longer life. Studies show that individuals in the top income quintiles live significantly longer than those in lower ones. Yet most life expectancy assumptions are based on general population averages. Static planning ignores medical and technological advancements. Innovations in medicine, diagnostics, and treatments extend lifespans. A fixed plan doesn’t account for progress that may add years to your life. Psychological behavior skews decision-making. When clients see a retirement plan that ends at age 90, they subconsciously think of it as a finish line. That can distort spending behavior by either being too cautious or too reckless. To improve accuracy and confidence, your retirement plan should treat life expectancy as a dynamic probability, not a static endpoint. The Two Biggest Retirement Risks: Longevity vs. Mortality Longevity Risk: What If I Live Too Long? One of the most overlooked dangers in retirement planning is the longevity risk, which is the risk of living longer than expected and running out of money as a result. While it may seem like a “good problem to have,” it can be financially devastating if not planned for correctly. Many retirees assume they’ll live into their 80s and base their savings and withdrawal strategy accordingly. But the truth is, you could live 10 to 15 years longer than expected, especially with improvements in healthcare and genetics working in your favor. Without a flexible, sustainable income strategy, these extra years can put serious stress on your portfolio. This is, by far, the biggest concern we see with investors nearing retirement. Example: Jane’s Retirement Plan Jane, 65, retires with $3.5 million in savings. She plans for a 30-year retirement (to age 95). She withdraws $120,000 per year from her IRAs to help cover expenses. If she lives beyond 95, she could run out of money. The problem? Jane doesn’t know if she’ll live to 75 or 105. A 30-year retirement is no longer rare. If your plan only anticipates 20 to

Defensive Asset Allocation – What You Need to Know

Although investing is often described as a balance between risk and reward, most investors care more about one than the other. When the stock market is soaring, we chase returns. When it crashes, we wish we had been more cautious. This emotional tug-of-war is why asset allocation is important. It determines how your investments are spread across different asset classes like stocks, bonds, and commodities, ultimately influencing your portfolio’s risk and return. Contrary to what you may hear from investing pundits and prognosticators, markets are unpredictable. That’s why Defensive Asset Allocation (DAA) can be a useful investment strategy – it is designed to help investors manage risk, protect against downturns, and still participate in market growth. This approach blends momentum investing and risk management to adjust allocations dynamically, aiming for steady long-term gains while avoiding catastrophic losses. DAA differs from traditional asset allocation strategies by being proactive rather than reactive. Many investors follow a fixed allocation strategy, meaning they hold onto their investments regardless of market conditions. DAA, however, continually evaluates market trends and adjusts accordingly. If you define market timing as trying to predict when the markets will rise or fall, then we feel that nobody can consistently time the markets. But appropriately responding to events is something we all can do. DAA doesn’t predict crashes—it responds to them as quickly as possible. Investing is never about avoiding risk entirely—it’s about managing it wisely. A well-structured portfolio should not only capitalize on growth opportunities, but it should also shield against significant losses. The financial landscape is littered with investors who suffered severe setbacks because they failed to adjust to changing conditions. Defensive Asset Allocation provides an alternative, allowing investors to stay engaged with the market while mitigating excessive downside risk. This strategy is particularly valuable during times of economic uncertainty when traditional investment approaches may struggle to adapt quickly enough. By the end of this guide, you’ll understand what Defensive Asset Allocation is, how it works, its pros and cons, and whether it suits your investment goals. What is Defense Asset Allocation? Defensive Asset Allocation (DAA) was developed by Wouter Keller and JW Keuning as an investment strategy that reacts to market trends rather than predicting them. Unlike traditional buy-and-hold methods, DAA actively adjusts a portfolio based on market conditions, focusing on capital preservation and steady returns. Core Principles of DAA Momentum-Based Investing – DAA prioritizes assets with strong recent performance, a principle rooted in behavioral finance: assets that have been rising tend to continue rising, and vice versa. By identifying these trends early, DAA captures upside potential while systematically cutting exposure to declining assets. This ensures that capital is allocated efficiently, reducing the chances of being stuck in prolonged downtrends. Momentum is one of the few verified anomalies in the markets. Breadth Momentum – This concept tracks the overall market’s strength. If only a few assets are performing well while the rest lag, it signals potential trouble ahead. Breadth momentum provides insight into whether a rally is broad-based or driven by a handful of stocks. If market participation weakens, the strategy shifts toward defensive positions, helping investors avoid market corrections before they fully unfold. This principle is important for spotting early warning signs of downturns and preventing significant portfolio losses. Defensive Shifts – When market conditions weaken, DAA reallocates into safer investments like government bonds, cash, or defensive assets to mitigate risk. Unlike traditional strategies that stay fully invested in equities regardless of volatility, DAA proactively moves capital away from riskier positions when warning signals emerge. This ability to switch between risk-on and risk-off modes helps smooth returns and reduces drawdowns so that investors are not caught off guard by sudden market downturns. Adaptive Rebalancing – Unlike traditional rebalancing methods that follow a fixed schedule, DAA employs adaptive rebalancing based on market conditions. This means it adjusts allocations dynamically rather than waiting for a pre-set date. When the market exhibits strength, DAA increases exposure to high-momentum assets. When risk indicators rise, it moves swiftly into defensive positions. This approach provides a continuous, responsive framework that enhances portfolio resilience. Adaptive rebalancing not only maximizes participation in bullish trends but also acts as an insurance mechanism against prolonged downturns, making it a key differentiator of DAA from static asset allocation models. The goal is simple: protect against downturns while maintaining steady growth. Why Traditional Strategies Can Fall Short Most investors are familiar with buy-and-hold or the 60/40 portfolio, where 60% of investments are in equities and 40% in bonds. While these approaches have worked historically, they are not immune to severe drawdowns. In 2008 and 2020, markets crashed rapidly, and many investors saw years of gains wiped out in months. DAA offers an alternative by making tactical asset allocation decisions. If market signals turn negative, the strategy moves towards defensive investments to avoid deep losses. Key Componets of Defense Asset Allocation 1. Asset Allocation Breakdown A typical DAA portfolio consists of: 43% Equities (stocks, ETFs, and exchange-traded funds covering broad markets) 40% Bonds (government and investment-grade bonds) 17% Alternative Assets (real estate investment trusts, gold, commodities) This diversification ensures exposure to growth while maintaining downside protection. A well-balanced portfolio mitigates risk by spreading investments across various asset classes, reducing the impact of volatility in any single market. This allocation is also flexible – adjustments are made based on market conditions to optimize performance. The combination of equities for growth, bonds for stability, and alternative assets for hedging enhances resilience in different economic environments. This diversification ensures exposure to growth while maintaining downside protection. A well-balanced portfolio mitigates risk by spreading investments across various asset classes, reducing the impact of volatility in any single market. This allocation is also flexible – adjustments are made based on market conditions to optimize performance. The combination of equities for growth, bonds for stability, and alternative assets for hedging enhances resilience in different economic environments. 2. Momentum Investing Markets are constantly shifting, and DAA allows your portfolio to remain on the right side of momentum. Instead of blindly holding assets, it allocates more to the

The Top 9 Questions Every Investor Should Ask Themselves

Investing is often seen as a purely rational pursuit—analyzing data, making calculated decisions, and expecting consistent outcomes. Many times, when an outcome is not what we expected, we often tell ourselves there was one or two pieces of data we inadvertently left out of our analysis.

What is Mechanical Market Timing?

For decades, investors have debated the best methods for maximizing returns while minimizing risk. One of the most enduring debates among investors is the quest for market timing.

Keller’s Bold Asset Allocation: A 101 Guide

For many investors, asset allocation feels like the backbone of a well-constructed portfolio. The idea is simple enough: spread your investments across different asset classes like stocks, bonds, and cash to balance risk and reward.

The Mama Bear Portfolio: Everything You Need to Know

Investing, at its core, is about achieving a balance – A balance between risk and reward, between growth and stability, and between your present needs and your future goals.

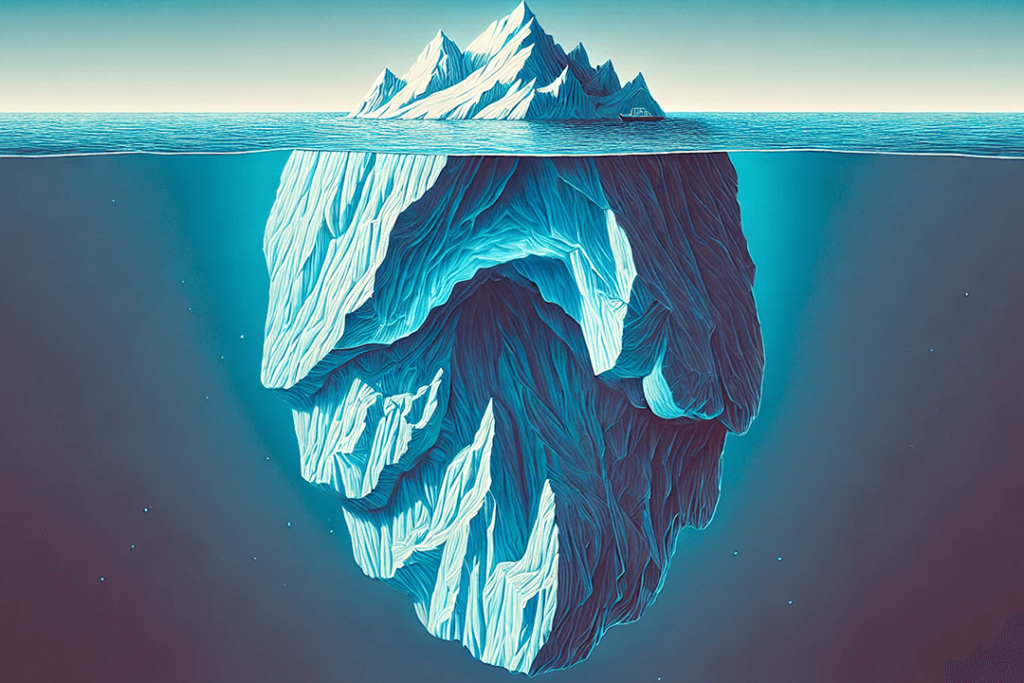

What are the Investment Risks we Cannot See?

In 1952, Ray Bradbury wrote a short sci-fi story about a safari hunter who travels back in time. The hunter pays an outfitter to ride aboard their time machine.