STRATEGIES(Click Strategy for graphs and metrics) |

2024 YTD

thru Feb. |

1 Year |

Past 5 Years1 |

Past 10 Years1 | Maximum DAILY Drawdown1,2 | Sharpe Ratio1,3 |

|---|---|---|---|---|---|---|

| BOND BASED MODEL |

|

|

|

|

|

|

| -0.32% | 3.43% | 1.42% | 1.68% | 10.13% | 0.81% | |

S&P® US Aggregate Bond Index4 |

-1.37% | 3.71% | 0.83% | 1.44% | 16.89% | 0.45% |

|

|

|

|

|

|

|

|

|

EQUITY BASED MODELS

|

|

|

|

|

|

|

| 3.90% | 11.23% | 9.41% | 7.56% | 14.64% | 1.20% | |

| 5.90% | 12.94% | 12.03% | 9.76% | 21.58% | 1.03% | |

| 6.40% | 17.87% | 16.47% | 14.49% | 20.60% | 1.42% | |

| 6.81% | 33.84% | 19.70% | 17.74% | 29.10% | 1.26% | |

S&P500® Total Return5 |

7.11% | 30.38% | 14.76% | 12.70% | 55.25% | 0.50% |

All returns net of highest possible fee charged. Your actual return may be different.

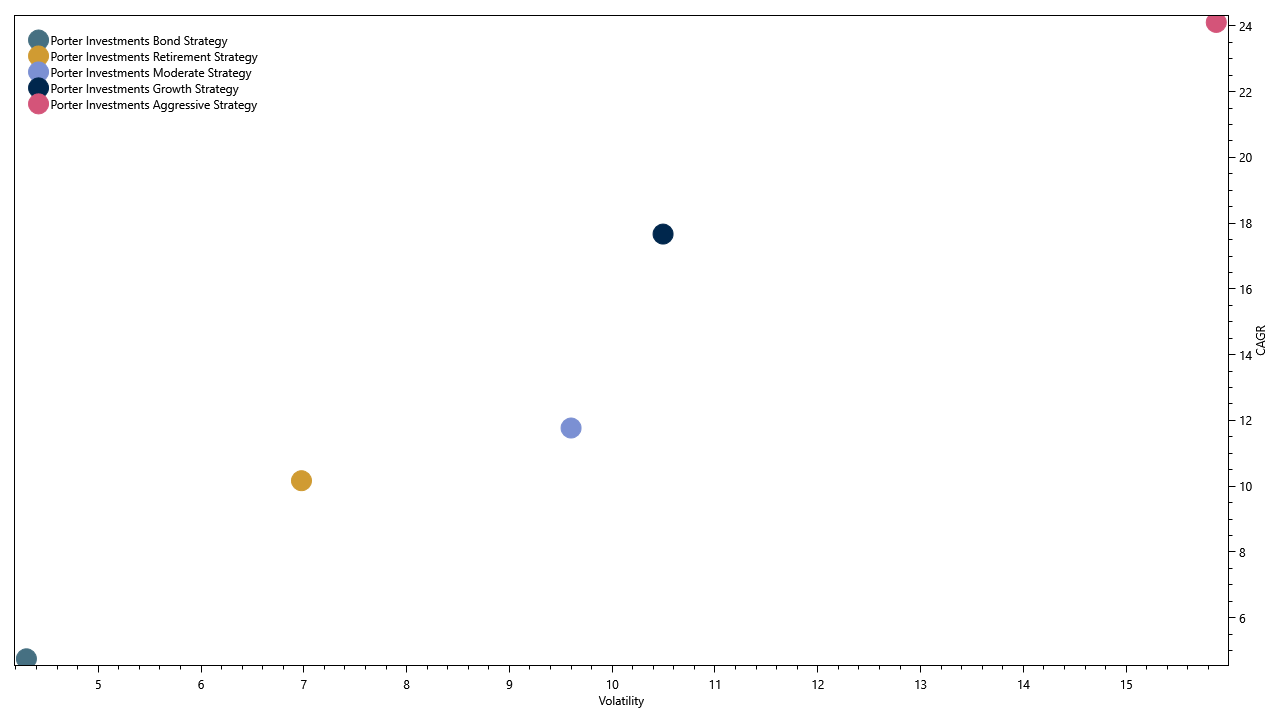

Strategy Comparison - CAGR vs. Volatility*

* Volatility measured as Standard Deviation of Monthly Returns, Annualized.

1 Period may include both hypothetical and actual returns. Please read Disclosure for detailed explanation.

2 Many firms choose monthly drawdowns, which will under report your actual drop when the market recovers before the end of the month. We calculate the maximum daily drawdown, which is expressed as a negative percent and refers to the maximum drop in a strategy's account value daily peak to valley, since inception. Inception is 1/1/2007.

3 The Sharpe Ratio will give an indication of how well the Strategy pays you (thru the CAGR) for the risk (as measured by the Standard Deviation) you incur. It is basically the Compound Annual Growth Rate divided by the Standard Deviation. The measure of risk you are trying to determine is the excess over a risk-free rate of return, or a three-month US Treasury bill. Generally, a higher number is better.

4 The S&P U.S. Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. The index is part of the S&P AggregateTM Bond Index family and includes U.S. treasuries, quasi-governments, corporates, taxable municipal bonds, foreign agency, supranational, federal agency, and non-U.S. debentures, covered bonds, and residential mortgage pass-throughs.

5 The S&P 500 Total Return Index® is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation. The returns include reinvestment of all dividends and capital gains. You cannot directly invest in an Index. S&P 500 is a registered service mark of Standard & Poor's Financial Services LLC.

Third party trademarks and service marks are the property of their respective owners.

Returns should not be considered indicative of the skill of the adviser. Returns may not reflect the impact that any material market or economic factors have had on the adviser's use of the back-tested models if the models had been used during the period to actually manage client assets.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. Please see DISCLOSURE for important information regarding this page.